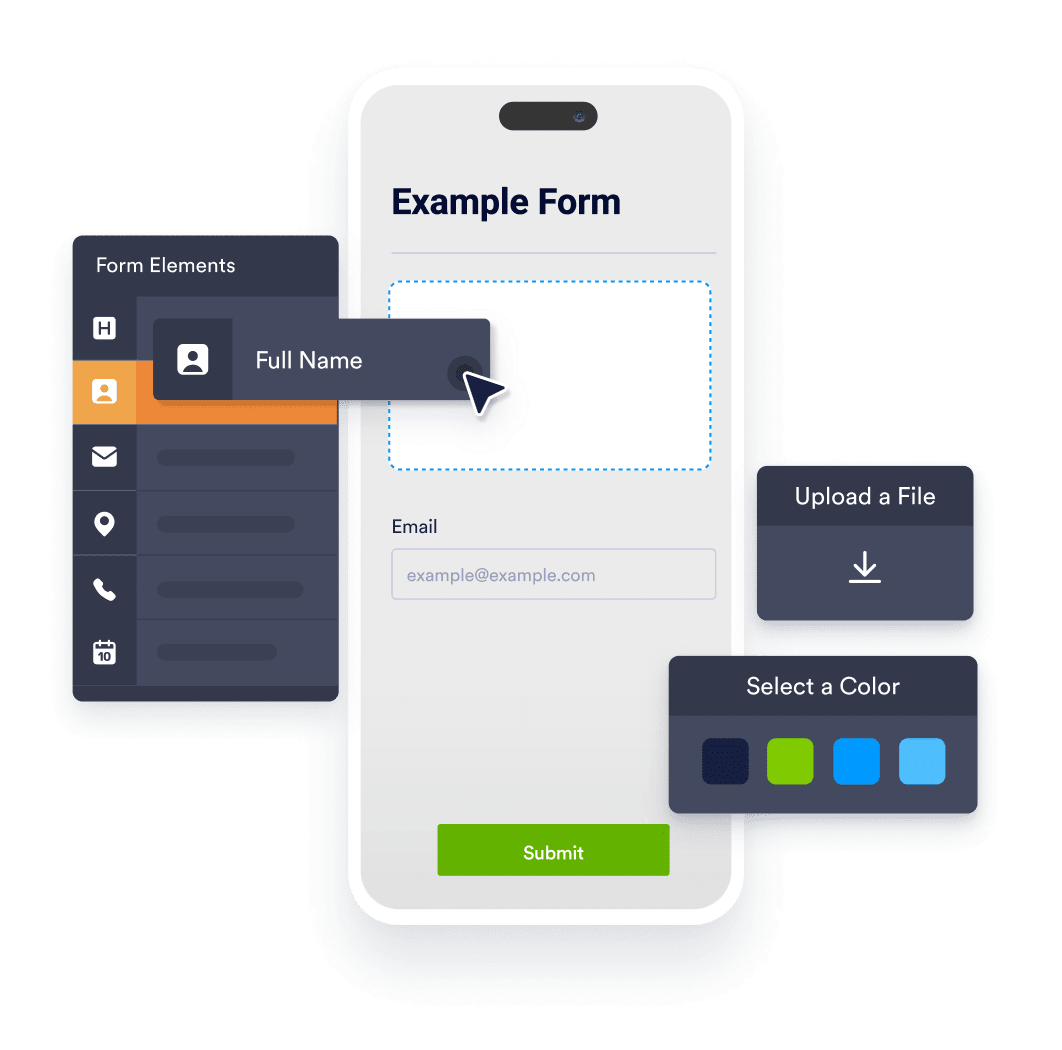

Make your tax forms match your needs and branding. Drag and drop to rearrange fields, split your online tax form into multiple pages, and add your logo and brand colors with no coding required.

W9 Generator

Generate W9 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

W2 Generator

Generate W2 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1099 Generator

Generate 1099 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1040 생성기

사용자 친화적인 양식 작성 도구를 사용하여 번거로움 없이 1040개 양식을 생성하세요. 세금 서류 절차를 쉽게 간소화하세요.

W8-BEN Generator

Generate W8-BEN forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1040-SE Generator

Generate 1040SE forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1098 Generator

Generate your 1098 form hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1098-E Generator

Generate your 1098-E form hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1098-T Generator

Generate your 1098-T form hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1099-NEC Generator

Generate 1099-NEC forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

1099-R 생성기

사용자 친화적인 양식 작성 도구를 사용하여 번거로움 없이 1099-R 양식을 생성하세요. 세금 서류 절차를 쉽게 간소화하세요.

1310 Generator

Generate 1310 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

2120 Generator

Generate 2120 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

4506 Generator

Generate 4506 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

4506-T Generator

Generate 4506-T forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

4868 Generator

Generate 4868 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

5329 Generator

Generate 5329 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

7004 Generator

Generate 7004 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

W8-BEN-E Generator

Generate W8-BEN-E forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

W4 Generator

Generate W4 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

W4P Generator

Generate W4P forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

540 Generator

Generate 540 forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

540-ES Generator

Generate 540-ES forms hassle-free with our user-friendly form builder. Streamline your tax documentation process with ease.

Your search "" did not match any results. Need a different form? Request it here.

원하는 세금 양식 생성기를 찾을 수 없나요? 아래 양식을 작성하여 알려주시면 필요한 양식을 작성하는 데 도움을 드리겠습니다!

양식 요청Benefits of Tax Form Generator

Upload a tax form and convert it into an online form. With Jform Sign, you can create tax documents, add multiple signers, and share your documents to be filled out and signed securely on any device.

Embed your tax form on your website or share it with a link to collect tax information from others. Jform protects data with a 256-bit SSL connection and the option to encrypt your forms, so you’ll rest easy knowing that data is secure.

Manage form submissions in Jform Tables in a spreadsheet, a calendar, or easy-to-read cards. By keeping track of tax information in one place, you can keep your tax forms organized and access them on any device.

Add the Form Calculation widget to your tax forms to automatically perform calculations. No coding required — just set up calculations in your tax form’s settings in a few easy clicks.

Jform에 대한 사용자의 의견

“... Jform has been great in helping us organize our forms.”

“Jotform has been great in helping us organize our forms. What was previously a hodgepodge of different .pdf forms from various companies, all being updated at different times is now a single online form with Jotform. We can be sure that we have the most up-to-date form with correct information using Jotform.”

—Brandon Blevins,

제어 전문가

Learn More About Tax Forms

-

What is a W-2 form? When and why do you need a W-2 form?

Form W-2 — or Wage and Tax Statement — is a United States tax form that shows important tax information, including the income a taxpayer has earned, the amount of taxes that have been withheld from their paycheck, benefits information, and more. Taxpayers need Form W-2 when filing state and federal taxes.

-

What does a W-2 form look like?

-

What is a W-4 form? When and why do you need a W-4 form?

-

What does a W-4 form look like?

-

What is a W-9 form? When and why do you need a W-9 form?

-

What does a W-9 form look like?

-

What is the difference between Form W-2, Form W-4, and Form W-9?

-

Are there any major deadlines for tax forms?

-

What are the most common mistakes to avoid?